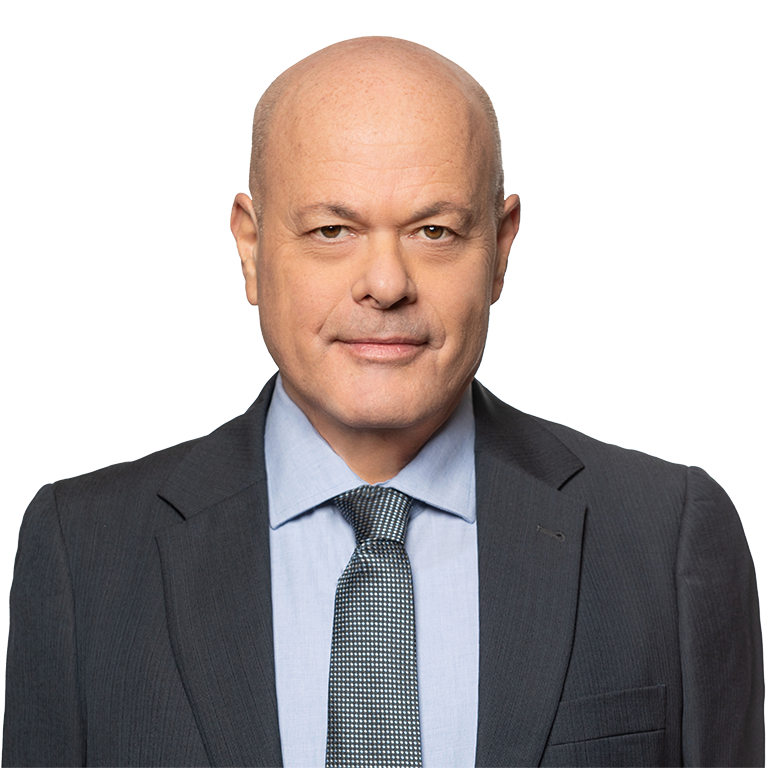

Profile

Doni Toledano is the Head of the M&A and Banking and Finance Departments.

He represents domestic and foreign corporations, both private and public, banks and financial institutions, as well as private equity and venture capital firms in a variety of Israeli and cross border transactions.

Doni has extensive experience and expertise in mergers and acquisitions, corporate finance, private equity, securities regulation and general corporate practice. He has a special focus on transactions involving entities in heavily regulated industries, such as insurance companies, investment houses, banks and corporations operating in the in the telecom and defense industries.

Representative Experience

Mergers & Acquisitions

- Representation of DoorDash in the contemplated acquisition of Wolt in a US$8.1 billion all-stock transaction

- Representation of the Tene Funds in the acquisition of a control stake in Haifa Chemicals according to a valuation of US$600 million.

- Representation of Apax Partners in the sale of Psagot Investment House to Altshuler Shaham for NIS910 million

- Representation of Bank Mizrahi Tefahot Ltd. in its acquisition of Union Bank of Israel Ltd. at a value of NIS 1.4 billion.

- Representation of the private equity firm, Hellman & Friedman, in the purchase of the Israeli cyber security company, Checkmarx Ltd., in consideration of USD 1.15 billion

- Representation of the XIO Group in the sale of Lumenis Ltd. to BPEA fund in consideration of more than US$ 1 billion.

- Representation of Tosca Services, LLC, a US based company, in the acquisition of Polymer Logistics.

- Representation of US company 1-800 Contacts, in the purchase of the Israeli startup 6over6 Vision Ltd.

- Representation of Carasso Motors Ltd., in the acquisition of 100% of Cal Auto, through the assumption of all its financial liabilities, valued at approximately NIS 1 billion.

- Representation of APAX in a share purchase transaction of SR Accord Ltd. for an amount of approximately NIS130 million.

- Representation of David Shield, travel and health insurance agency, in a complex process for the establishment and registration of a new insurance company.

- Sale by private equity fund, Permira of its controlling stake in the Israeli drip irrigation pioneer Netafim to Mexichem, a Mexican public company for US $1.9 billion.

- On-going acquisition by Mizrahi-Tefahot Bank of Union Bank for approximately US $400 million.

- On-going acquisition by Sirius Insurance Group of a controlling stake in the Israeli Phoenix Insurance Company at a company valuation of approximately US $1.4 billion.

- Acquisition of Lumenis Ltd. by an entity controlled by the XIO Group in consideration of approximately US$ 514 million.

- Acquisition of Blue Square Ltd. by a company controlled by Moti ben Moshe including a creditors’ settlement in the amount of approximately US$ 350 million.

- Acquisition by Israel Oil and Gas Fund in the acquisition of the Sonol Petrol Company from the Azrieli Group for NIS 364 million.

- Acquisition of 25% of Mashav (sole shareholder of Nesher, a major cement manufacturer) by Clal Industries Ltd. from the Irish conglomerate CRH Europe.

- Acquisition of Hyperion Therapeutics, Inc. by Horizon Pharma plc for approximately US$ 1.1 billion.

- Reverse triangular merger of a subsidiary of Access Industries with Clal Industries Ltd. in consideration of approximately US$ 350 million.

- Acquisition of a controlling interest in Partner-Orange by the Saban Group in consideration for approximately US$ 400 million.

- Acquisition of the daily newspaper Maariv by Makor Rishon.

- Acquisition of a controlling interest in Partner-Orange by the Saban Group in consideration for approximately US$ 400 million.

Banking & Finance

- Representation of the XIO Group and Lumenis Ltd. in a financing transaction with Mizrahi-Tefahot Bank, in connection with the acquisition of Lumenis.

- Representation of Apax Partners and Psagot Investment House in a refinancing transaction with a consortium led by Bank Hapoalim.

- Representation of Netafim Ltd. in a refinancing transaction of approximately US$ 500 million with a consortium led by Bank Hapoalim.

- Representation of Mizrahi-Tefahot Bank in a financing transaction of Polymer logistics in the amount of approximately US$ 75 million.

- Representation of Nilit Ltd. in an US$ 80 million financing transaction with a consortium of institutional investors led by Mizrahi-Tefahot Bank.

- Representation of Apax Partners as the controlling shareholder of Tnuva before the Israeli banks in a NIS2.5 billion refinancing transaction.

Biography

Bar Admissions

Israel Bar, 1988

Michigan Bar, 1991

Education

LL.B., The Hebrew University of Jerusalem, Israel, 1987

LL.M., University of Michigan, US, 1990

Prior Experience

Doni performed his legal internship for Justice Meir Shamgar, former Chief Justice of the Supreme Court of Israel.

He was an associate in the firm of Mishael Cheshin & Co. in Jerusalem.

Between 1990 and 1993 Doni was an associate at the New York law firm of Reid & Priest and the Detroit law firm of Honigman, Miller, Schwartz & Cohn.

Doni was a partner in the Tel Aviv law firms of Haim Zadok & Co. and Zellermayer, Pelossof, Rosovsky, Tsafrir, Toledano & Co. until he joined Erdinast, Ben Nathan, Toledano & Co. in early 2016

Languages

Hebrew, English and basic command of Arabic.

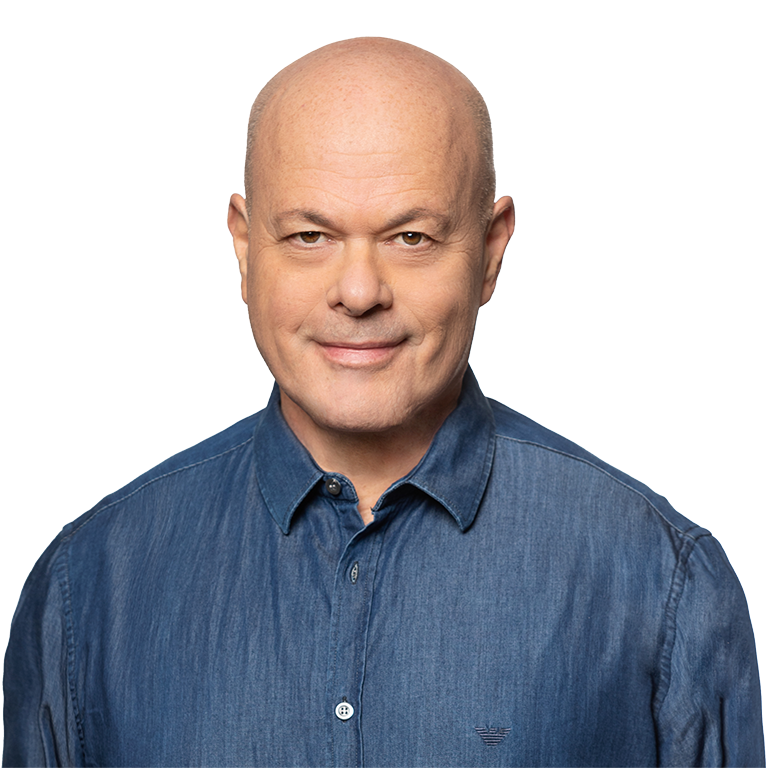

Congratulations to our client, Gesher I Acquisition Corp, a Special Purpose Acquisition Company (SPAC), for consummating a business combination with Freightos Limited, a company which operates a leading freight booking and payment platform. Following the successful merger, Freightos is now traded on Nasdaq under the ticker symbol CRGO.

The transaction was led by partners Doni Toledano, Shay Dayan and Nitzan Aberbach, along with associates Alon Abramovich and Narda Vasquez Arancibia (M&A and Corporate Department). Also assisted partner Lior Etgar (Privacy and Data Protection Department), partner Hadas Erenberg (Labor Law Department) and intern Ariella Mankowitz.

To read the full article, click here.